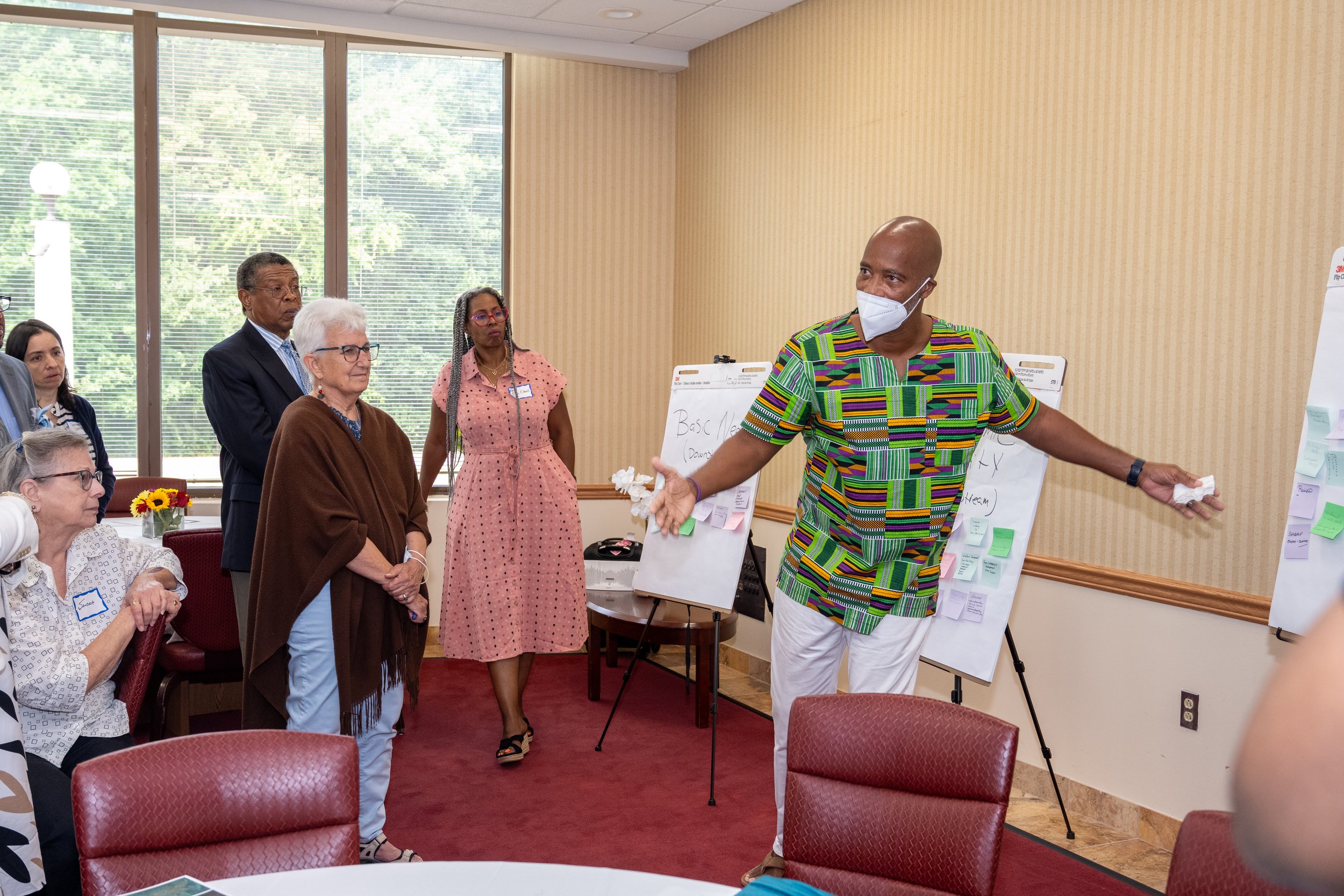

birdSEED recipient Tiffany (Coco) Brown, at her new home in Prince George’s County.

For years, Tiffany (Coco) Brown had dreamed of accomplishing something that no one else in her family had ever done before – purchasing a house that she could call home.

“I wanted someplace where my family could gather and be together,” Coco shared. “Someplace safe that we could call ‘ours’.”

Like many Black families in the Greater Washington region, as a child Coco’s parents could only afford to rent their home in Washington, DC. As economic conditions in the housing market turned, Coco remembers moving several times over the course of her childhood, leaving behind friends and childhood memories as the family sought out a new place to live.

“Growing up, I knew I wanted to live in my own house,” Coco shared. “I just wasn’t sure where to start.”

In 2021, Coco decided to pursue her dream of becoming a homeowner. But while navigating the world of real estate can be complicated for just about anybody, studies show that it has been historically – even deliberately – complex for people of color.

According to a recent study by the National Association of Realtors, only 44% of Black Americans are homeowners – compared to 73% of White Americans. The disparity, which is built on a foundation of decades of redlining and discriminatory lending practices, represents the largest racial homeownership gap in the past decade.

“There’s not very many things out there for people who look like me,” she added. “When it comes to buying a house, we don’t have the resources or the information to get the help we need.”

Over the course of her housing search, Coco went through four different realtors, mountains of paperwork, and dozens of house tours. She also enrolled in several programs designed to help first-time homebuyers – which she soon discovered involved even more paperwork and strict eligibility requirements.

“Pack your patience,” she recalled of her experience. “It’s a lot.”

That was when she heard about the Housing Justice & Down Payment Assistance Program at the birdSEED Foundation – a non-profit organization born from a collaboration between Nest DC (formerly known as Flock DC) – which provided the initial funding to seed the program - and the Greater Washington Community Foundation. The program provides grants of $5,000 - $15,000 to Black & Brown first-time homebuyers with no strings attached.

“This is our work to do – helping those who have been historically disadvantaged to purchase homes,” shared lisa wise, CEO of Nest DC and founder of birdSEED.

birdSEED is boldly branded as a ‘housing justice’ initiative – a starting point for reparations from an industry that has played a major role in the creation of the racial wealth gap.

“Homeownership is one of the most effective ways that Americans build intergenerational wealth,” Darius Graham, Managing Director of Community Investment at The Community Foundation stated. “And even though equal access to housing is a civil right enshrined in our nation’s laws, systemic racism within housing institutions have kept communities of color from accessing it for far too long.”

“[birdSEED] isn’t about philanthropy,” wise added. “It’s about wealth creation; it’s about transferring and building wealth – and creating a model for the rest of the business community that we hope others will follow.”

birdSEED was designed to take away as many barriers for Black and Brown homebuyers to receive support, as possible. The application process is kept intentionally simple and is open year-round, with grants awarded twice a year by a panel of volunteer advisory board members. Once awarded, grant recipients have 120 days to close on a home and release the funds, which are managed by The Community Foundation.

“We are laser focused on making no strings attached down payment grants,” Leslie Case, Executive Director of birdSEED added. “If we can focus more on the giving and less on the accountability, we believe we can give more and have a bigger impact.”

Since its launch in September 2020, birdSEED has awarded 41 provisional grants to help Black and Brown first-time homebuyers – including Coco -- get one step closer to their dream of home ownership.

“birdSEED was a lifesaver,” Coco said. “Without them, I don’t think I would have gone to closing.”

Coco submitted her birdSEED application in September 2022—and within a month was awarded a $10,000 provisional grant. Five months later, Coco closed on her dream home in Hillcrest Heights in Prince George’s County, Maryland.

“The fact that [the homebuying search] is over, is such a stress reliever,” Coco shared, as she approaches her one-year anniversary of homeownership. “To be able to spend holidays, birthdays, and game nights in my own space with the ones I love is a wonderful experience.”

While wise, Case, and The Community Foundation celebrate the success of birdSEED, we also acknowledge how much work remains to be done to close the racial homeownership gap. Of the 41 provisional grants awarded to Black and Brown first-time homebuyers through birdSEED, some of them have still been unable to close on a house – a humbling testament to the many challenges that first-time homebuyers of color must overcome on the road to homeownership.

Despite the challenges, wise and Coco say that birdSEED provides a beacon of hope that they hope will continue to spread to more members of the Greater Washington community.

“A lot of people ask what they can do – especially when confronted with big issues like the racial wealth gap,” wise said. “You can start with this –a down payment towards building a more equitable community. It may seem like a small step – but it’s a huge step in the right direction.”

One evidence of that hope came from Coco, who when asked what advice she had for fellow aspiring homeowners, simply stated the following:

“If I can do it, you can do it”

The Community Foundation is proud to award the birdSEED Foundation with a $100,000 grant to support homeownership for residents of Prince George’s County and Montgomery County. The investment is part of our Together, We Prosper campaign investment strategy to close the racial wealth gap in the Greater Washington region. For more information, visit our website or contact [email protected]