Our quarterly DMV Community Book Group met in August for a deep dive into the insightful article “What We Get Wrong About Closing the Racial Wealth Gap.”

“Nothing tells us about economic well-being more than the racial wealth gap,” Anne Price, the first female President of the Insight Center for Community Economic Development and co-author of the article, shared to a group of thirty friends and partners of The Community Foundation.

“But before we tackle the racial wealth gap, we have to come to terms with just how little we understand it and the conflicting narratives that surround it.”

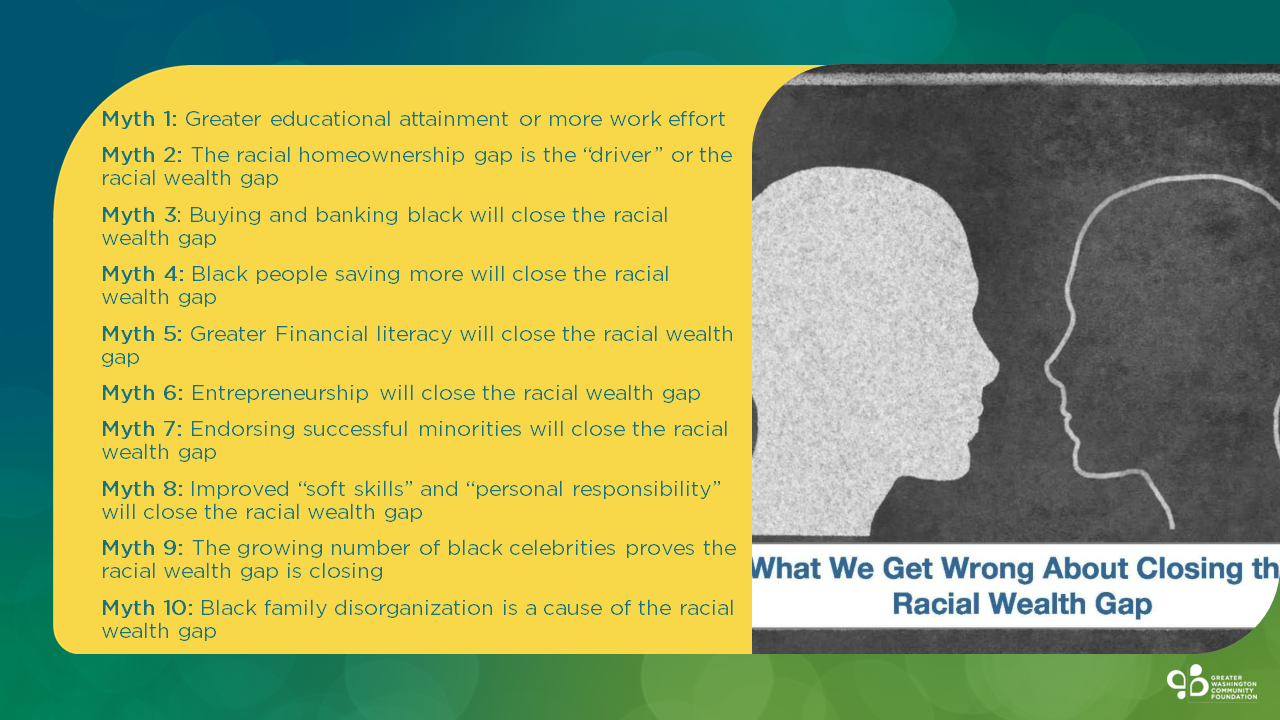

In the article, Price and her co-authors address ten commonly held myths about the racial wealth gap – conventional ideas including “greater educational attainment, harder work, better financial decisions, and other changes in habits and practices on the part of Blacks.”

The article goes on to explain that “while these steps are not necessarily undesirable, they are wholly inadequate to bridge the racial chasm in wealth.”

Price explained that one of the reasons these ideas often fall short is because they follow a narrow, individualistic approach rather than recognizing the necessity of the need for broader systemic change.

“We have taken a deeply structural problem that is hundreds of years in the making and overlaid it with very small individual solutions, based on flawed and often false narratives.”

Some of those attending the discussion were surprised by some of the narratives that Price addressed – including widely accepted narratives such as the ideas that access to higher education or homeownership can close the racial wealth gap.

“The data clearly shows that wealth creates equalized educational outcomes and opportunities for homeownership – not the other way around,” Price explained.

While tackling higher education and homeownership may help close the gap somewhat, they are not “one-size fits all” solutions. In addition, Price pointed out that both approaches are riddled with systemic obstacles – such as student debt, predatory lending and racial bias-- that policymakers and changemakers alike often overlook.

“When we talk about building Black wealth, too often we get stuck behind these blinders that limit our perspective to just four areas – education, entrepreneurship, financial literacy, & homeownership,” Price explains. “There is so much more to wealth than that.”

Ronnie Galvin, Managing Director of Community Investment for The Community Foundation, echoed Price’s assertion: “Black people will not be able to build wealth in the same ways that White people have built wealth. If we are serious about doing this work, we need to be willing to expand our horizons and work with Black communities to identify and adopt more innovative and systemic approaches.”

One of the approaches that Price suggested was to seek to eliminate wealth extraction. She shared several simple, short-term solutions such as advocating for the end of garnishment policies and forgiving criminal legal debt.

“We need to seek for solutions that not only put more money in people’s pockets, but also give them piece of mind,” Price added. “Because wealth is more than just financial outcomes. We need to consider the social, mental, and emotional aspects as well.”

Rather than seeking a programmatic “silver bullet” to close the racial wealth gap, Price suggested taking a step back and re-examining what wealth means. She described wealth as “allowing us to live and retire with greater dignity, freedom and peace of mind” and providing “future generations with the freedom to dream big and become all they truly can be” with a focus on being “healthy, spiritually whole and contributing.”

Price explained that wealth (and wealth building solutions) are far more complex and distinct than most people realize.

“I’m so thankful that we have this space to expand our horizons and our imagination, as a foundation,” President and CEO Tonia Wellons shared. “We do not know everything – we’ve said that from the beginning – which is why we continue to build this ‘coalition of the willing’ – people who are willing to join us on this learning journey.”

“Together we will continue to learn, discover, and refine new ways to think about the work that we get to do in philanthropy, as we center our efforts around closing the racial wealth gap.”

Click here to watch a full recording of the August 2022 DMV Community Book Club. Our next DMV Community Book Club will be in December 2022 when we will discuss ‘Solidarity Economics: Why Mutuality and Movements Matter’ by Chris Benner & Manuel Pastor.

If you would like to join our discussion, please subscribe to our monthly newsletter to receive information on how to register!